The Coronavirus pandemic has clearly affected the global economy, in some cases massively, forcing just about all sectors to rethink their business models for the near future. The automotive sector has been particularly damaged.

Unlikely other big crisis that happened in the last years, it is difficult to ascribe this one to demand or supply shocks, and therefor to make predictions and define what the best stabilization policy could be. Moreover, everything happened so fast, and in such an unpredicted way and scale, that it made just about impossible to analyze the situation due to a lack of objective and reliable data.

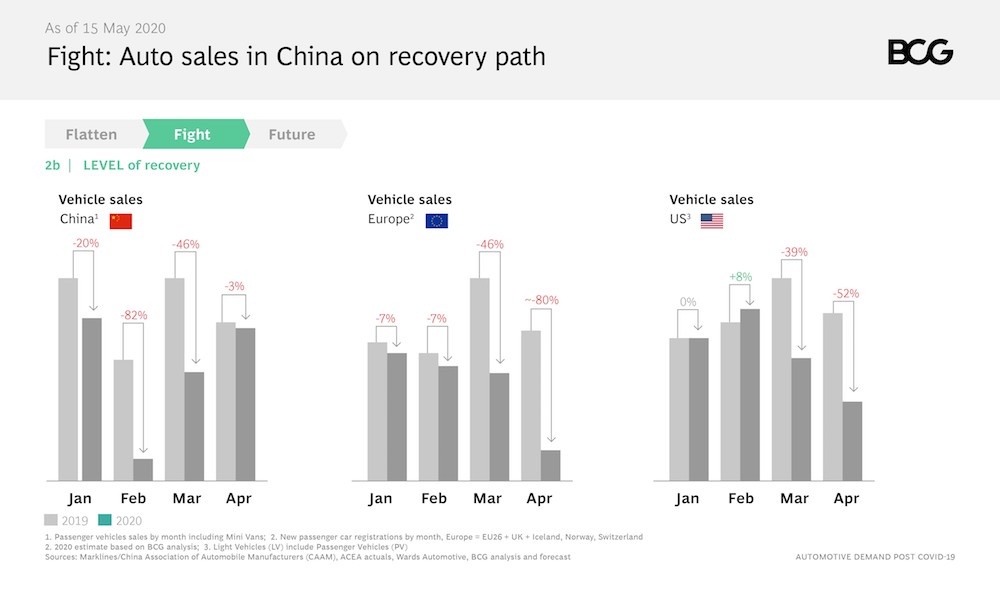

BCG data show us a near apocalyptic scenario.

Generally, the situation is rife with contradictions, making it hard to truly unravel.

Confusion in the automotive sector

The sector is about to confront a very complex period, characterized by a series of factors, which further confuse the dynamics.

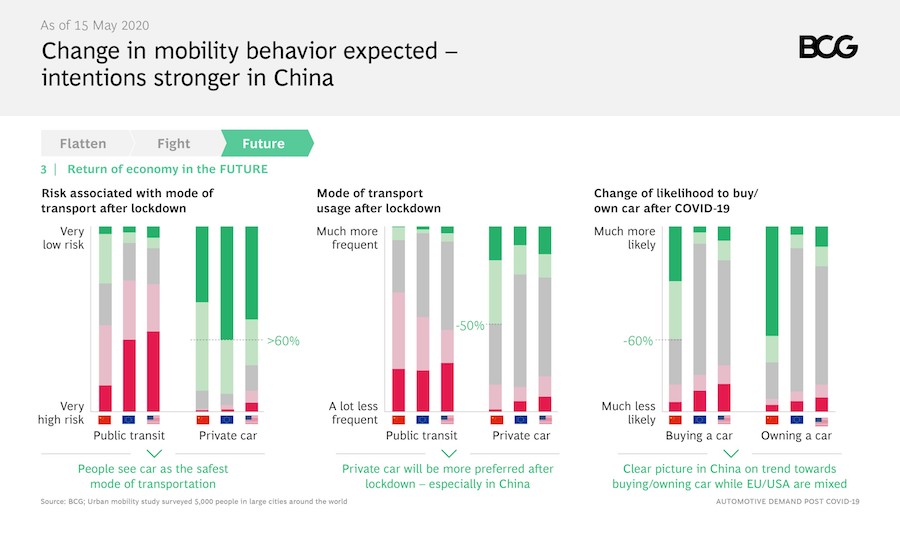

On one side, we find a population segment that has discovered the advantages of smart working, downgrading vehicles from a basic necessity to a useful commodity. On the other, government incentives and support that can facilitate business transactions in the near future (especially for those commuters who do not feel safe boarding crowded means of public transportation), but will not do much for those who feel they do not need a private car, or cannot afford its ownership.

For those who already decided to buy a car, the next point is: what kind of car? With few exceptions, many employees have had their salaries restructured, thus making additional costs difficult to manage. So perhaps this will encourage the purchase of small city cars, and low-cost hatchbacks? We will see what the most popular vehicle segments will be.

To sum up, making forecasts of the post-Covid world for the automotive sector is tough, but the players in the sector already went forward, imagining some kind of scenario that they are beginning to create as you read.

What can we expect from the post-Covid-19 automotive sector?

In the last six months, businesses worldwide have been forced to close or reduce their activities for health and safety reasons, many individuals have lost their income or jobs, and there is hardly no-one selling and indeed no-one buying.

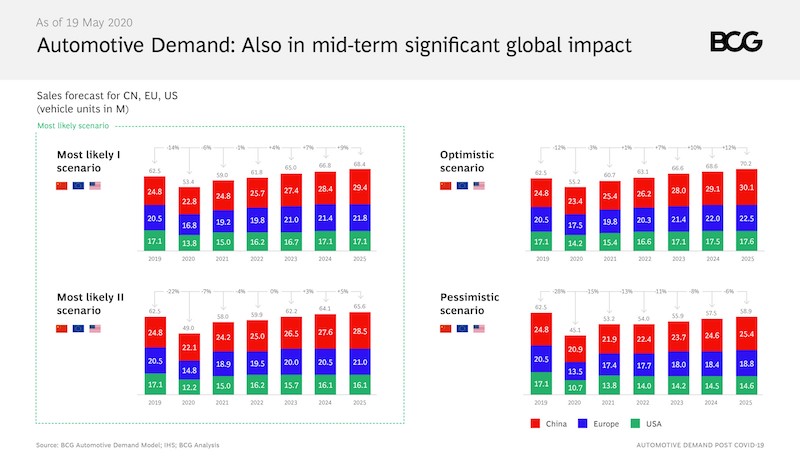

However, forecasts indicate a drop in production in 2020 (between 14% and 22%), with slow growth starting in 2021, to return to pre-Covid levels in 2024-2025. This is widely considered the most-likely case scenario.

So, given this slow-recovery outlook, what are the measures taken by the automotive sector to boost demand in the short and medium term?

So, given this slow-recovery outlook, what are the measures taken by the automotive sector to boost demand in the short and medium term?

Contactless sales

Hygiene and the fear of infection are still important drivers of our behavior, and will be for a while, even in the automotive sector.

Going to visit a car showroom, entering a display vehicle, touching potentially contaminated surfaces; all of these activities can represent a cause of concern for potential clients.

This is why auto dealerships and automakers are seeing an increased demand for contactless sales, which have been tested with a series of experiments in recent years, and became relevant with the easing of Covid-19-related lockdown restrictions in many Countries.

Offering a contactless sales procedure to customers can include online ordering, digital walkarounds to demonstrate the vehicle's features and home delivery of vehicles for test drives – these kind of experiences might be key for the future of the industry.

Electric vehicles

Disruptive events encourage change, in every sector. The widespread diffusion of hybrids and electric cars, despite a positive adoption rate in recent years, is yet to reach its full potential - perhaps the right moment has come for this kind of investment.

The environmental matter has forced its way into the public conscience during the pandemic, thus an increasingly higher number of users have declared their intent to purchase an alternative fuel vehicle.

As highlighted by Deloitte in the Global Automotive Consumer Study 2020 report:

Interest in more ecological technologies is growing in the USA (29% - 41%) despite multiple unfavourable factors (relatively low petrol and diesel prices, less fiscal incentives etc.).

Generally speaking, in all Countries (but China, which already has the highest penetration of alternative drivetrains in the world), the share of consumers willing to choose a BEV or PHEV as their next vehicle is increasing, while the long-time preference for traditional powertrains is shrinking.

Driverless cars

It does appear that driverless cars are taking the hardest hit. Whilst in the past we imagined mainstream use for transporting people (for example taxis or minibuses) today the outlook has changed.

The average user appears to be less inclined to enter a car used by other people without the presence of a driver who can take responsibility for the cleanliness and disinfection of the vehicle between journeys.

The value chain

Industry in general, and automotive in particular, has taken on an increasingly-global aspect over recent decades, decentralizing not only production plants and the manufacture of vehicles, but also parts and raw materials sourcing, thus creating an increasingly complex network.

The production stops in China and Asia, and the subsequent lockdowns in the rest of the world, have put that system under pressure, preventing businesses, even in Countries who were yet to have problems with the virus, to be able to access parts coming from abroad.

This business model, effective and flexible in some aspects, has shown itself to be a double-edged sword, and many companies are going back to the drawing board with their contingency plans, seriously evaluating how to avoid these problems in the future.

Home and smart working

As previously mentioned, a large slice of the population had to reorganize their work life, moving it from downtown offices to their home.

Smart working, or home working, has undoubtedly affected the automotive and transport sectors, forcing many people to reevaluate their dependent relationships on their vehicles.

Besides the behavior of the single worker, who will still need a car, if not for work at least for personal needs, we should think about the evident drop in company car purchases.

If managers and employees work from their homes, and manage meetings and work chats remotely, why would anyone need a company car?

Conclusions

Making precise forecasts about how the automotive sector will change post-Covid-19 is practically impossible. Companies up and down the value chain are feeling the pressure of supply and demand disruption, and public concern for health and financial well-being has slowed global economies.

The magnitude of this challenge is clear as industry forecasts see global new vehicle sales to total just more than 70 million units in 2020, a downgrade of 18.5 million from January’s estimates. Roughly, the equivalent of this year’s light vehicle sales expectations in the United Kingdom, Japan, and the United States combined.

A full demand recovery will take some time. An immediate, V-shaped rebound is looking increasingly improbable, as various government assistance initiatives will start to dissipate in the coming months, leaving consumers to face the full reality of a diminished financial capacity. Coupled with the sheer caution being applied by companies in their reopening efforts, and the specter of a second wave of COVID-19, sustained financial strain could result in a consumer retrenchment, truncating economic growth for the foreseeable future.

The pandemic started just as the global automotive industry was headed into a cyclical slowdown. It also found global automakers already under intense pressure to maintain their research and development spending with no guarantee of a return on investment, and in critical need to develop new business models. The full impact of the pandemic will remain unclear for at least several more months. What is already very clear is the need for industry stakeholders (manufacturers, suppliers, retailers, financial institutions, and governments) to collaborate to understand exactly what actions are needed in order to tackle these incredibly complex issues and get the global automotive engine running smoothly again.