Car ownership, for upcoming generations, won’t be a necessity, above all for those living in medium/large cities with good public transport systems.

In addition, let’s remember increasing adoption at a really local level of car-sharing/pooling services, other services such as Uber, improved railway connections etc all of which we can put into a macro category defined as shared mobility.

But does shared mobility really represent a change in standard models for the automotive industry?

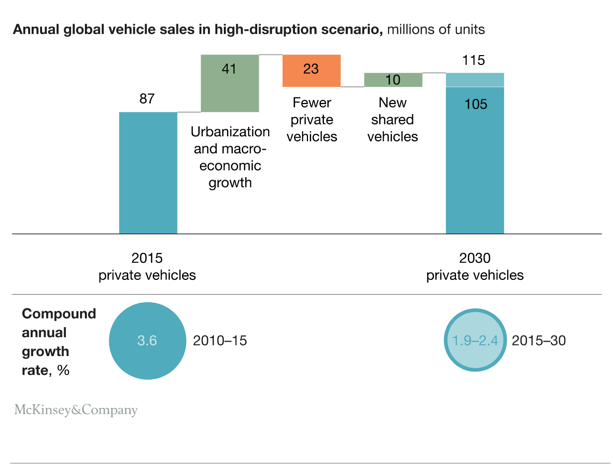

According to data supplied by McKinsey roughly a third of the expected increase in vehicle sales by 2030 (due to urbanisation and macroeconomic growth) simply won’t occur due to mobility sharing.

Shared mobility: the impact of developing countries

For a more in-depth and indeed more complete analysis, however, we must take into account an often underrated factor.

In reality the people who benefit the most from the advantages offered by shared mobility are those living in developing countries, where pro-capita income is low, and therefore a proportion of the population is unable to purchase a vehicle.

For example, according to some forecasts, it is estimated that in China a third of the population will regularly use car-sharing and other mobility sharing services for urban journeys by 2050. That means over 600 million people per day.

So in essence, what perhaps appeared to be a fad in large western cities, is in fact a small revolution occurring in the automotive sector, to which we should give due attention.

It’s also true, however, that an increase in pro-capita income is forecast for the coming years, which will be followed by an increase in the number of vehicles sold.

This should to some extent counterbalance the effects of shared mobility on the automotive sector revenue.

Shared Mobility: numbers and forecasts for the future

According to McKinsey, across the three main world regions (China, Europe and the USA) the mobility sharing market was approximately 54 billion dollars in 2016, with forecasts for a marked increase.

The very best scenario, which suggests strong demand by clients for driverless taxis and shuttles (so-called robo-taxis/shuttles) in high-population density areas and indeed in areas that have adopted the correct measures to host such vehicles, means the market could reach an annual growth rate of 28% between 2015 and 2030.

But even the least positive scenario forecasts constant growth due to the low costs and benefits, with an annual growth rate of 15 %.

Conclusions

Excluding obvious exceptions, on average a vehicle is parked nearly 95% of the time. These numbers will discourage purchase, above all, when as we mentioned at the beginning of this article, in areas where public transport and car-sharing services work well.

Moreover, shared mobility means a lower number of cars on the roads, thus lower CO2 emissions, and that is why national and international state enterprises are favourably swayed by these services and are heavily incentivising them.

Business operations in the automotive sector must therefore commit to change, which we reiterate need not be drastic, by investing in shared mobility, making deals with industry players or by effectively becoming service providers themselves. Indeed they could use the sector as a beta-testing platform for new technology launches and implementation such as electric or driverless vehicles.