The haulage sector is undergoing a huge change, driven by new technology and innovation.

In particular, for some period now, an idea that really was just an idea a short time ago, is gradually becoming reality. We are talking about the production of electrically-powered and auto-piloted trucks.

It is, of course, true that the automobile market is still absorbing, albeit very rapidly, innovations in the electric vehicles sector. And then there is still a huge trust issue regards auto-piloting in general. But the future, increasingly closer each day, appears to be exactly in that direction.

Forecasts indicate a 10% of total production being electrically-powered vehicles in NAFTA area

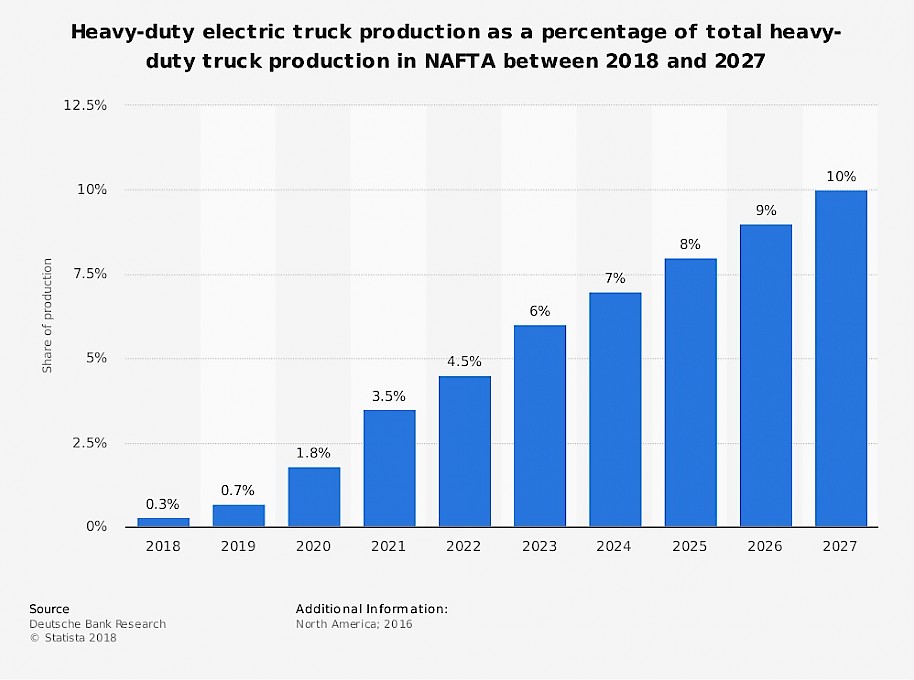

According to the report “Electric & Autonomous Truck Technology”, conducted by Deutsche Bank Markets Research, the production of electrically-powered trucks, between 2018 and 2027, will reach 10% of all production in the NAFTA area.

As you will know, NAFTA stands for the North American Free Trade Agreement, a document signed in 1994 by the USA, Canada and Mexico.

The growth forecast is exponential, going from a miserly 0.3% to 10% in less than 10 years, therefore averaging an increase of almost 1% year on year.

This 10% more precisely refers to the production of class 8 trucks which are heavy trucks. If we widen the data range to include classes 5 to 7, then we are looking at 15% of total production, still within the same reference area.

To provide the complete picture, here below we have included a table of truck class subdivisions:

- class 1: light trucks, 0–6,000 pounds (0–2,722 kg);

- class 2: light trucks, 6,001–10,000 pounds (2,722–4,536 kg);

- class 3: light trucks, 10,001–14,000 pounds (4,536–6,350 kg);

- class 4: medium trucks, 14,001–16,000 pounds (6,351–7,257 kg);

- class 5: medium trucks, 16,001–19,500 pounds (7,258–8,845 kg);

- class 6: medium trucks, 19,501–26,000 pounds (8,846–11,793 kg);

- class 7: heavy trucks, 26,001–33,000 pounds (11,794–14,969 kg);

- class 8: heavy trucks, 33,001 pounds (14,969 kg);

- class 9: super heavy trucks (special duty trucks) 33,001 pounds (14,969 kg).

Forecasts for the European market

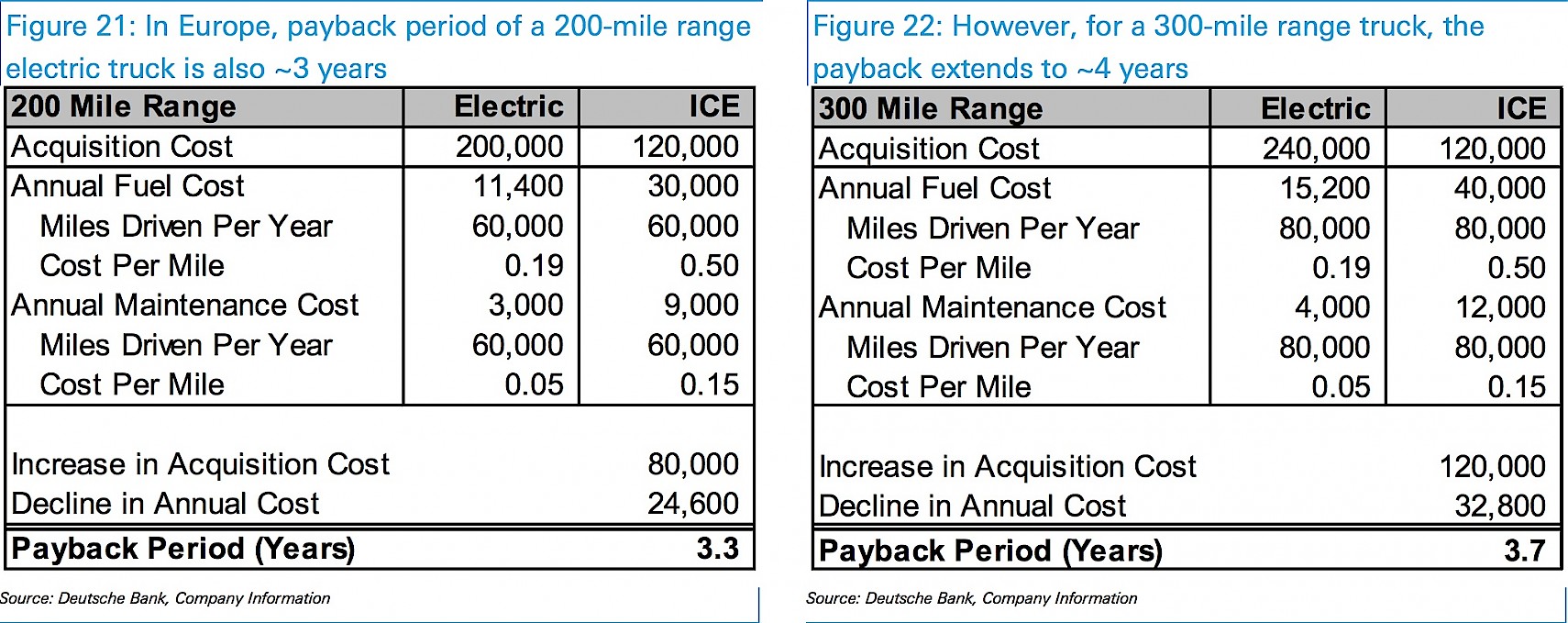

Furthermore, in the Deutsche Bank report, we can note a forecast for the European market is included, which is historically slower to adopt new technology in the electric vehicle sector.

Estimates made for a slightly briefer period, forecast a market penetration of just 2% by 2024.

Market influencers, however, are not only the will and ability of the large-scale European producers to manufacture electrically-powered trucks, but also the return-on-investment timescale.

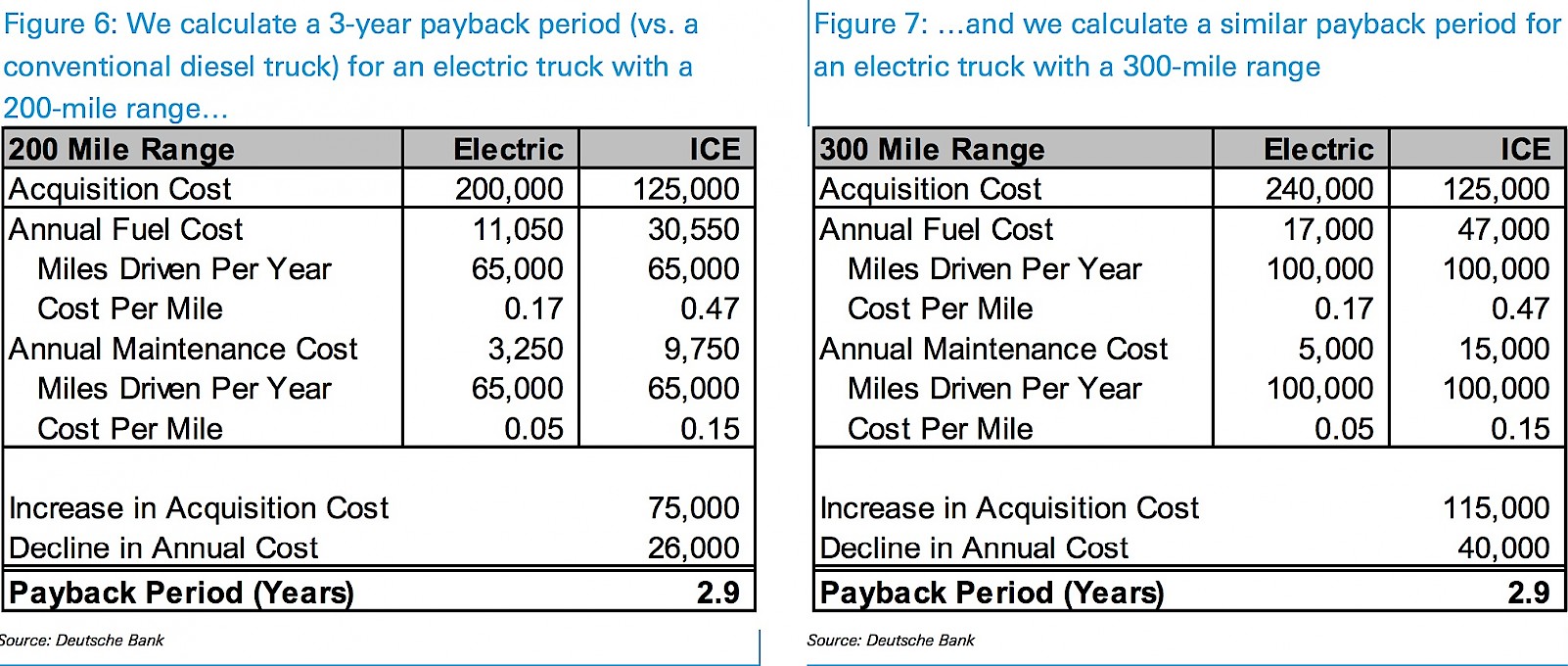

If we assume purchase price to be equal for an electrically-powered truck, then in order to gain a return on the investment made in terms of fuel savings, there is considerable divergence between the USA and Europe.

The following graph makes the comparison. Data is extrapolated from the report.

Research and state incentives

In recent times we are witnessing frenetic research, by the biggest key players on the world scene and by private and public research centres, to find new materials and new chemical processes for batteries.

This research, together with an increase in state incentives, may stimulate growth of the electrically-powered truck sector.

So potentially, the currently optimistic forecasts from the Deutsche Bank report may actually prove to be low in the face of what will actually happen.