To enable consumer-centric electricity, or generally speaking utilities markets, consumers should be equipped at least with a smart meter, as provided in the Directive of the European Parliament released in 2019. Despite the roll-out target of 80% of consumers equipped with a smart meter by 2020, this achievement seems still a bit far.

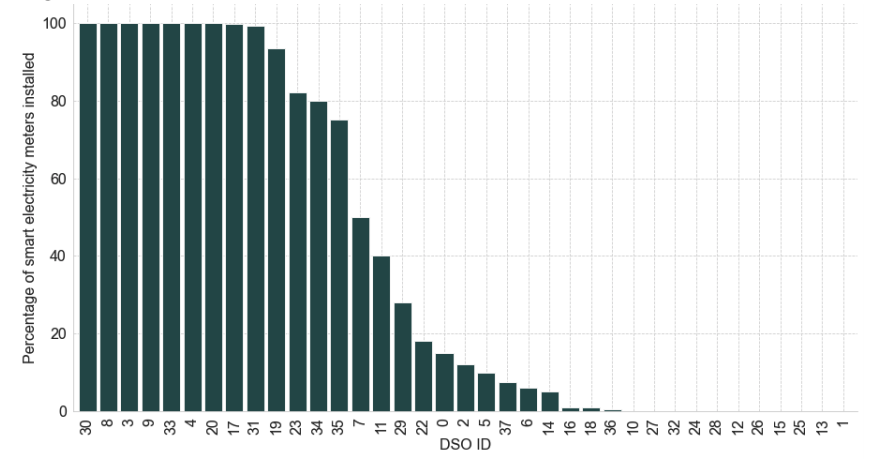

The following graph shows the percentage of smart meters installed in their respective control areas by each Distribution System Operator surveyed by the Joint Research Centre in collaboration with Directorate-General ENER Energy of the European Union, including both AMI (Automated Metering Infrastructure) and AMR (Automatic Meter Reading). Of the 37 European DSOs who have replied to the survey, 34 declared that there is currently some action concerning smart metering installation taking place in their control area, regardless of official national plans adopted.

Smart electricity meters installed per each DSO (% of total metering points per DSO) Source: JRC, 2020.

Interestingly, smart metering roll-out is taking place also outside Europe: the 7 Non-EU DSOs in the report sample also provided data about their roll-out status, ranging from a minimum of 3% to a maximum of 16% of their total customers. This is a positive signal, provided that no official target has been adopted in non-EU countries yet, showing that smart metering roll-out is seen as beneficial also where no legislative requirements provide for it.

Of almost 140 million metering points managed by the European DSOs replying to this survey, around 88 million have already been replaced with smart meters, equivalent to 63% of their total metering points. In order to achieve at least the 80% target in the control areas of each DSO who replied to this survey, additional 23 million smart meters should be installed. Assuming an average cost of EURO 200 to equip each metering point with a smart meter, this would correspond to additional investments for roughly EURO 4.6 billion in the very next few years.

There are two facts worth mentioning here: first, the 80% target refers to each single EU country, while here 80% of the total customers served by the European DSOs has been considered; second, having 260 million electricity customers in Europe (according to data collected by Eurelectric in 2020) the investment need calculated still represents a lower bound of the needed investments in smart meters, provided that the customers served by the DSOs who replied to the survey are around 140 million (53%).

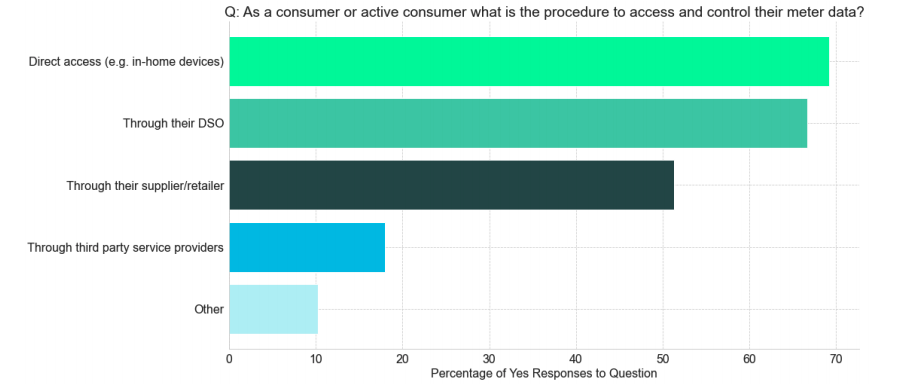

Let’s delve deeper into the matter: of those who have a smart meter installed (both AMI and AMR), how can consumers access their consumption data? Almost 70% have mentioned the option “direct access”, that is by using in-home devices, 66% have mentioned the possibility to get the data through the DSO, a slightly more than 50% mentioned that the supplier/retailer is in charge of this task and 18% mentioned that data are provided by third party service providers.

Options to retrieve data for final consumers Source: JRC, 2020

Covid's impact on DSOs activities

Another key factor to consider is the ability of the European Distribution System to be resilient to shocks, like the COVID-19 pandemic. The DSO association EDSO already in 2019 identified as one of its priorities the "innovative resilience", pointing out that climate change and other critical events are expected to pose increasing challenges to distribution grids operation. In order to respond, there is a need for developing additional or more appropriate metrics of distribution grid resilience, which can capture the granularity of unprecedented events. Such granularity tends to fade away when analysing year-round indicators like SAIDI and SAIFI (System Average Interruption Duration Index and Interruption Frequency Index), which cannot capture the frequency of high impact, low frequency events, just like the COVID-19 pandemic.

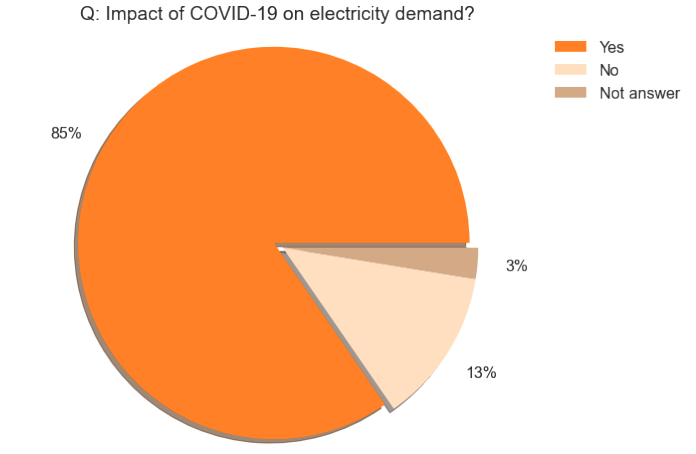

The vast majority of DSOs has experienced a decrease in electricity demand during the pandemic, which ranges from an estimated 17% decrease of electricity demand over the lockdown period in countries where the isolation measures were particularly harsh, to figures in the range of 1 − 3% in other less affected areas, with a median value of 5%.

Impact of Covid-19 on electricity Demand Source: JRC, 2020

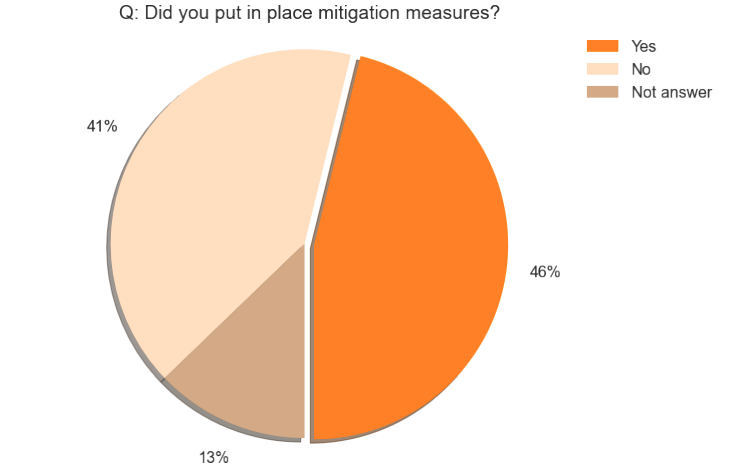

In terms of response of DSOs to the pandemic, only about half of the respondents affirmed that they have put in place mitigation measures, mostly related to personnel safety like strict shifts and, when possible, reduction of the personnel present at the premises. This, therefore, highlights how the pandemic has found many grid operators still unprepared. Within this context, a risk plan, helping the DSOs in identifying the proper crisis management and response when needed, might mitigate the expected effects of a future crisis not only on operational activities but also on long term investments, such as those forecasted to complete the deployment of smart metering.

Impact of Covid-19 on electricity Demand: mitigation measures Source: JRC, 2020