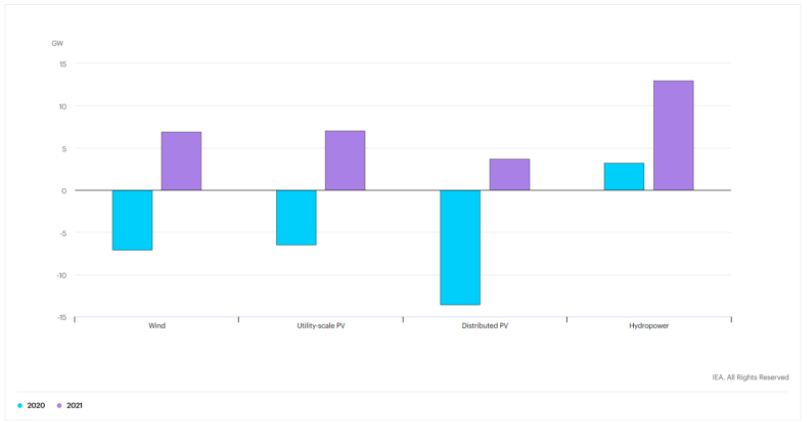

Renewable electricity net capacity additions growth by technology, 2020 and 2021

The European Commission published in middle July of 2021 a proposal to revise the Renewable Energy Directive. As part of the package “Delivering on the European Green Deal”, the Commission is seeking to accelerate the take-up of renewables in the EU to make a decisive contribution to its ambition of reducing net greenhouse gas emissions by at least 55% by 2030 – and ultimately becoming climate neutral by 2050.

Building on the Directive 2018/2001/EU, the proposal increases the current EU-level target of ‘at least 32%’ of renewable energy sources in the overall energy mix to at least 40% by 2030, which represents doubling the current renewables share of 19.7% in just a decade.

It also sets a comprehensive framework for the deployment of renewables across all sectors of the economy, in line with the Commission’s vision for the integrated energy system of the future. This revision focuses on sectors where progress in integrating renewables has been slower to date (such as transport, buildings and industry). Some of these measures take the form of additional targets, others are aimed more at simplifying administrative procedures and smoothing out bottlenecks under the current rules, for example by accelerating the permitting process. The proposal seeks to enable EU energy systems to become more flexible, making it easier to integrate renewables into the grid as efficiently as possible. This should enable district heating, heat pumps, home batteries and electric vehicles to fulfil their potential better. The proposal also supports the uptake of renewable hydrogen where electrification is more difficult.

And what about the rest of the world? The pandemic has the potential to change the priority of government policies and budgets, developers’ investment decisions and the availability of financing through 2025. This casts a great deal of uncertainty on the market of renewables, that had been expanding at a rapid pace in the previous five years.

At the same time, several countries are introducing massive stimulus programmes to respond to the current economic meltdown and support their economies. Some of these stimulus measures may be relevant for renewables. The International Energy Agency has been re-emphasising that governments should bear in mind the structural benefits of increasingly competitive renewables, such as economic development and job creation, while also reducing emissions and fostering technology innovation.

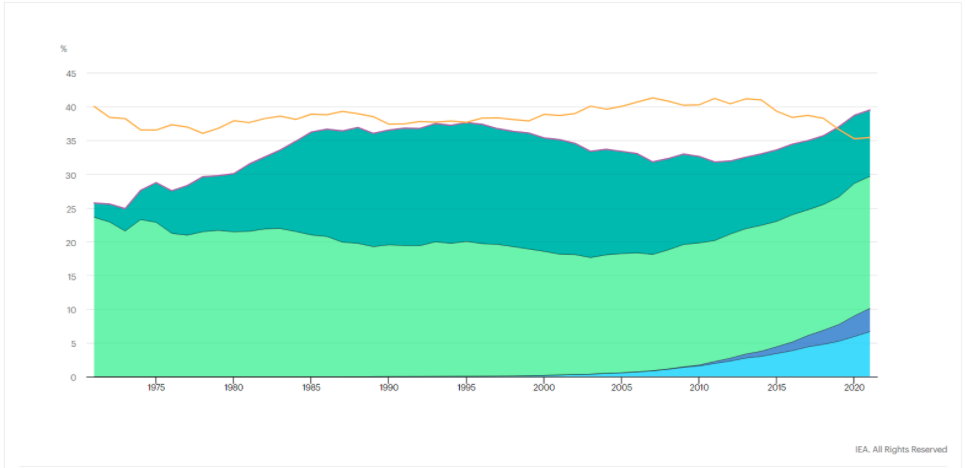

There is little doubt that massive cost reductions in the last decade are one of the main reasons behind renewables rapidly transforming the global electricity mix. The cost of electricity from onshore wind and solar PV is increasingly cheaper than from new and some existing fossil fuel plants. In most countries, renewables are the cheapest way of meeting growing demand. Note that renewable energy use increased 3% in 2020 as demand for all other fuels declined. The primary driver was an almost 7% growth in electricity generation from renewable sources.

Share of low-carbon sources and coal in world electricity generation, 1971-2021

Wind and solar PV developers in 2020 won auction bids at record low contract prices, ranging from below USD 20/MWh to 50/MWh. Offshore wind has achieved significant scale-up and cost reduction over recent years driven by policies in Europe. This success should soon be repeated in emerging offshore wind markets in Asia and North America, with economies of scale further reducing costs.

The increasing share of VRE has opened a new horizon to maximise hydropower’s contribution to flexibility and spur investment in battery storage technologies. All these developments were mainly driven by government policies fostering competition and new flexibility sources.

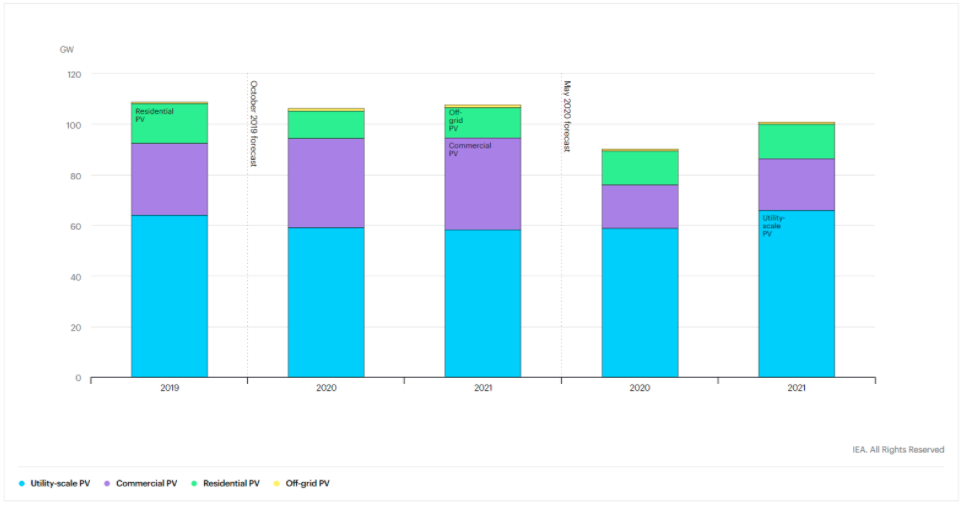

While supply disruptions may lead to local transitional price fluctuations, there is no sign to date that the Covid-19 crisis will change these declining cost trends. For instance, in the case of solar PV, manufacturing overcapacity is expected to reach record levels in the coming years, which will put further downward pressure on module prices.

Possible delays in construction activity due to supply chain disruptions, lockdown measures and social-distancing guidelines, and emerging financing challenges, may slow down the development in this sector. However, the majority of the delayed projects are expected to come online in 2021 and lead to a rebound in capacity additions. As a result, 2021 is forecast to almost reach the level of renewable capacity additions of 2019.

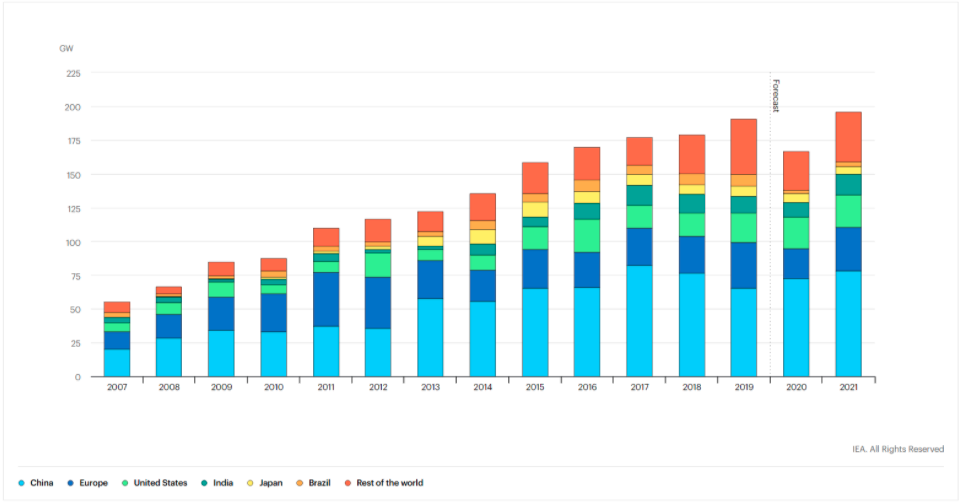

Renewable electricity capacity additions, 2007-2021, updated IEA forecast

Renewable electricity generation in 2021 is set to expand by more than 8% to reach 8 300 TWh, the fastest year-on-year growth since the 1970s. Solar PV and wind are set to contribute two-thirds of renewables growth. China alone should account for almost half of the global increase in renewable electricity in 2021, followed by the United States, the European Union and India.

Experience shows that the economic recovery after the last financial crisis resulted in significant growth in CO2 emissions: in 2010 global CO2 emissions saw the largest increase ever recorded – four times the drop in emissions the year before. To mitigate the increase in CO2 emissions in the recovery from the current crisis, governments should put clean energy transitions at the heart of their stimulus packages.

Solar PV capacity additions, 2019-2021, October 2019 forecast vs. May 2020 forecast

Sources: Commission presents Renewable Energy Directive revision, Global Energy Review 2021 and Renewable energy market update – Analysis - IEA