In 2024 annual battery demand surpassed 1 terawatt-hour (TWh)

2024 marked a historic year for the battery industry: for the first time, global demand exceeded 1 terawatt-hour (TWh), driven by strong growth in electric vehicle (EV) sales, which increased by 25% to 17 million units worldwide.

This momentum is the result of a virtuous circle, where rising sales and falling battery costs have fed off each other, paving the way for an ever-widening spread of electric mobility.

Prices down, efficiency up

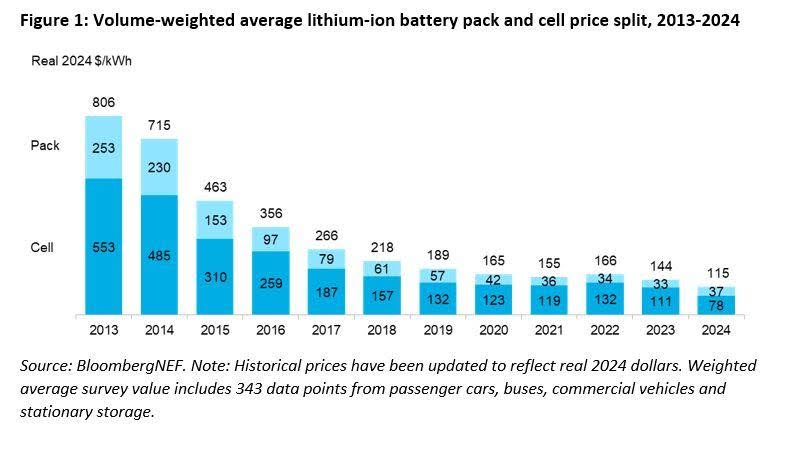

A key factor in this dynamic was the drastic drop in the average price of a battery system, which fell below the strategic threshold of $100 per kilowatt-hour in 2024. This level is considered crucial for the competitiveness of electric vehicles compared to conventional internal combustion vehicles.

The cost reduction is due not only to reduced raw material prices, (lithium in particular, dropped by more than 85% from the peak in 2022), but also to improvements in production efficiency and the expansion of global industrial capacity.

In 2024, global battery production capacity reached 3 TWh and it could triple in the next five years if the planned projects actually come to fruition. The industry is therefore in a maturity phase, evolving towards a standardised global market based on innovation, economies of scale and adaptability.

China leads, but the global landscape widens

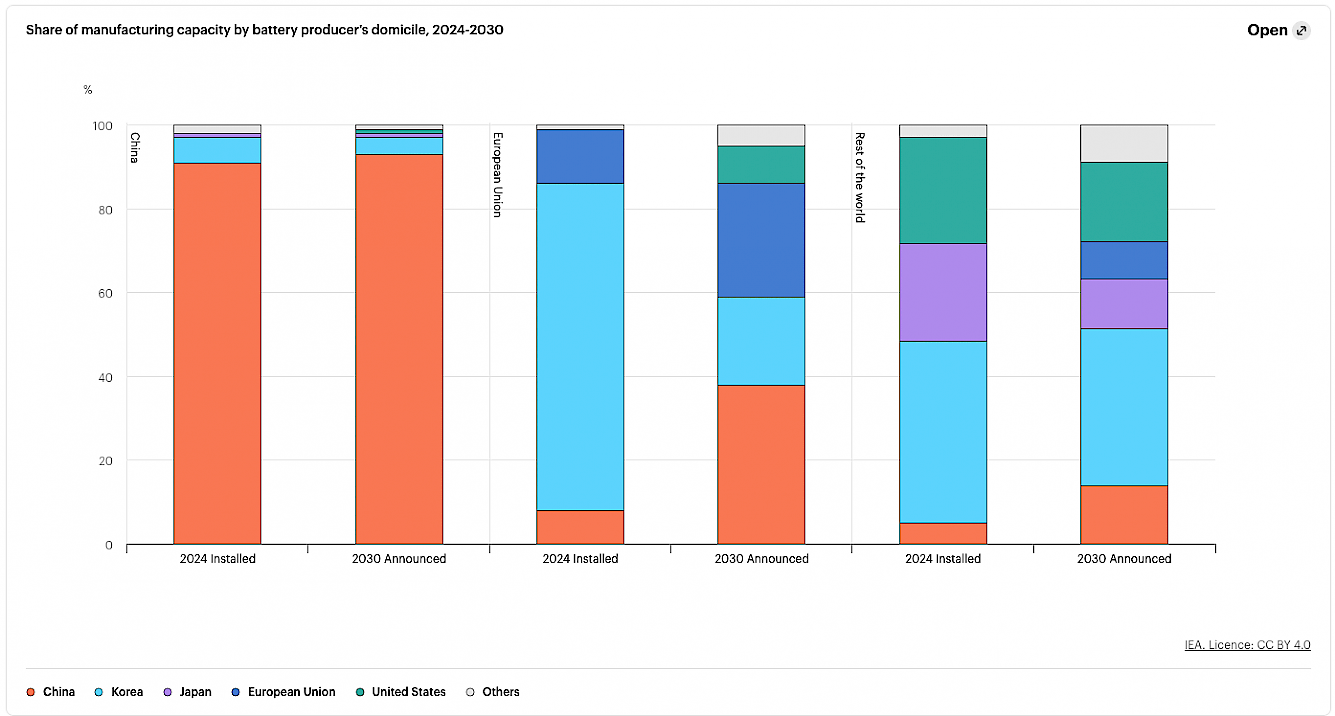

China leads the world in battery production, with over 75% of global capacity and prices dropping by 30% in 2024 alone. This often makes electric cars cheaper than conventional cars in the domestic market.

China's success is linked to strong vertical integration, covering the entire supply chain: from the extraction of raw materials to the final assembly of batteries. Driving this ecosystem are industrial giants such as CATL, the world's largest EV battery manufacturer, and BYD, which produces both batteries and electric vehicles.

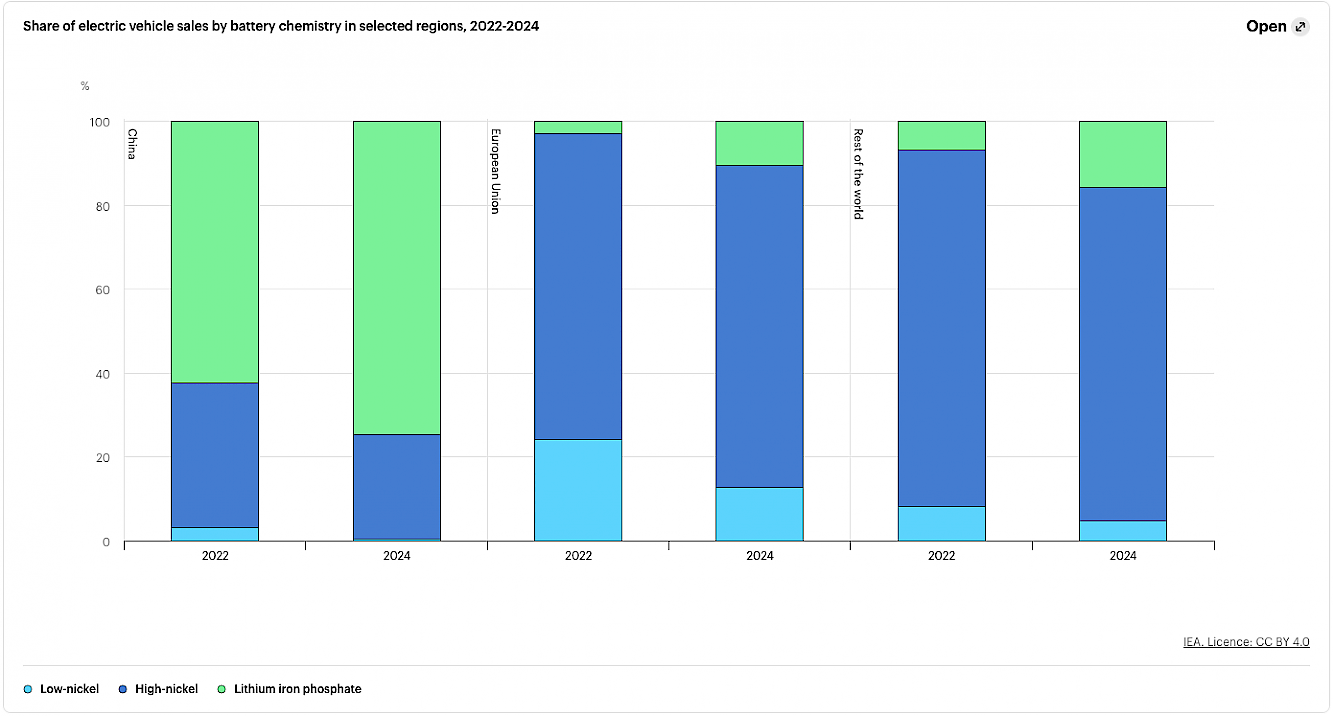

A further boost to cost containment comes from the growing popularity of LFP (lithium iron phosphate) technology, which is cheaper than NMC (nickel manganese cobalt) batteries, without compromising reliability and performance.

Beyond China: an expanding global ecosystem

Although China dominates the market, other countries are accelerating production. South Korea and Japan are playing an important role, bolstered by their expertise in NMC batteries and supported by foreign investment.

Korean companies, in particular, boast about 400 GWh of production capacity abroad, surpassing Japan and China in this segment.

New emerging areas, such as South-East Asia and Marocco, are also becoming strategic production hubs, thanks to key natural resources and favourable investment policies.

Indonesia, for instance, holds half of the world's nickel reserves and has already started production of batteries and components.

Marocco, on the other hand, offers large phosphate reserves and an established automotive supply chain, attracting increasing investment.

Challenges and opportunities for sustainable growth

However, the sector's growth is not without obstacles. High supply chain concentration in China and export restrictions on critical technologies have raised concerns about energy security and diversification.

Diversifying production and building resilient supply chains requires time, capital and constant demand. Sales of electric vehicles, which now account for 85% of global battery consumption, are the main driver of this growth.

To compete with China, countries and companies must invest in automation, digitisation, innovation and strategic alliances such as joint ventures and technology exchanges.

International cooperation will be essential, as no market alone can sustain such high investments. Partnerships with countries rich in raw materials - such as South America, Africa, Australia and Indonesia - will be crucial to build a stronger and more diversified supply chain.

Towards the future of the electricity sector

Data confirms that the battery industry is now the beating heart of the global energy transition. The combination of innovation, production efficiency and steady growth in demand guarantees a future of development and consolidation for the entire industry.

The real challenge will be to build an industry that is competitive but also resilient and sustainable, capable of responding to the requirements of an increasingly demanding and electrification-oriented world.