The International Energy Agency (IEA) report Electricity 2025 describes a profound and global transformation in electricity demand, driven by converging factors such as widespread electrification, digitalisation and the growing impact of climate change. According to the IEA we have entered a true 'new age of electricity', in which electricity consumption has become the backbone of the energy transition.

However, this evolution is manifesting itself in different ways across the major economic areas: India, the United States, China and Europe are each following unique trajectories, marked by specific opportunities but also by infrastructural, industrial and regulatory obstacles. In this context, the rapid expansion of low-emission sources, particularly renewables and nuclear, is contributing to a significant reduction in CO₂ intensity in the global electricity sector.

The report highlights that the success of this transition will not depend solely on technology, but above all on ambitious public policies and strategic investments in modern infrastructure, dynamic electricity markets and key technologies such as smart grids and energy storage systems. Targeted incentives will also be needed to support growing demand while ensuring the adequacy and security of the electricity system.

The results are already visible: in 2024, global CO₂ intensity fell by 3%, an acceleration compared to the -1% recorded in 2023. Projections for the period 2025–2027 indicate an even more pronounced trend, with an average annual decrease of 3.6%, which should bring the intensity from 445 gCO₂/kWh to around 400 gCO₂/kWh by 2027.

And finally, the flexibility of the electricity system is playing an increasingly important role, as it is essential for managing the intermittency of renewable sources and new loads related to heating, mobility and industry. Technologies such as demand response, grid-integrated electric vehicles (V2G) and distributed energy storage are becoming key tools for balancing the grid, improving operational reliability and strengthening the resilience of the electricity system in an increasingly complex and interconnected environment.

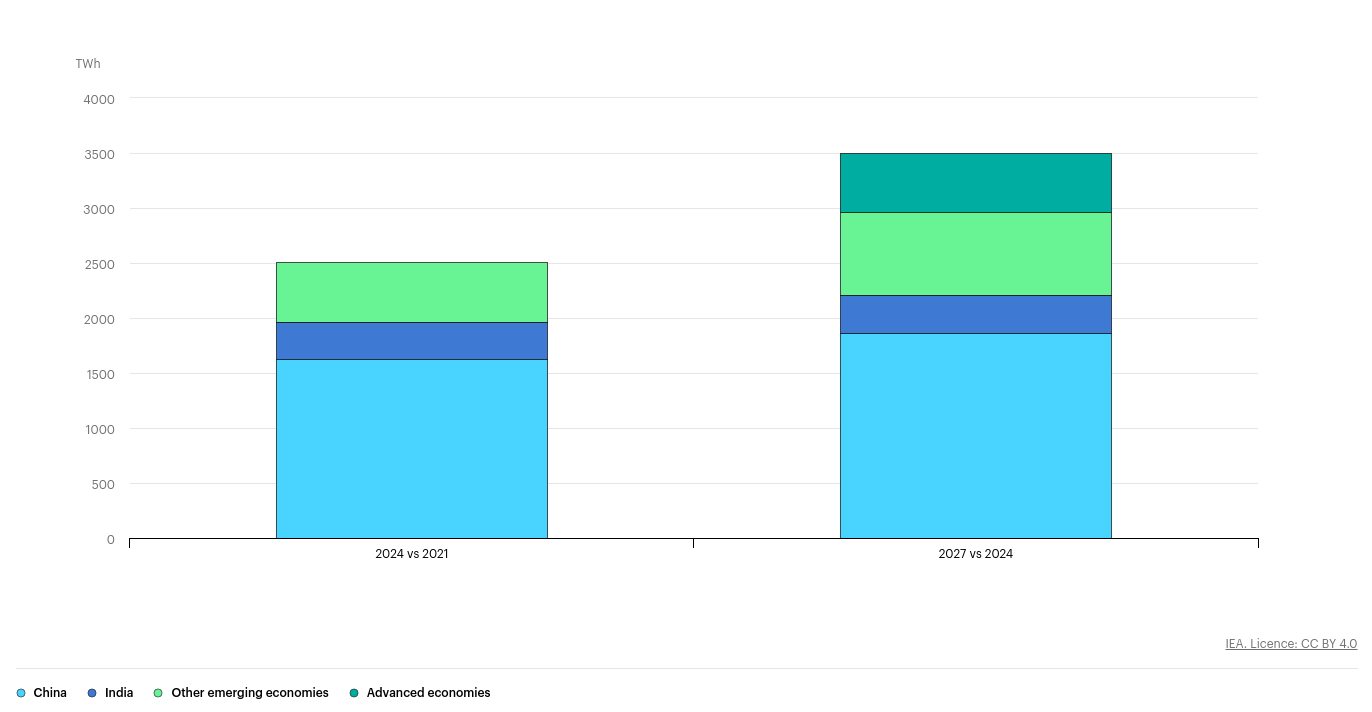

Change in electricity demand by region, 2021-2027 IEA.

India: explosive expansion under climate and infrastructure pressure

India is experiencing one of the fastest growth rates in electricity consumption globally, driven by rapid economic development, widespread electrification and extreme weather events. In the first half of 2024 alone, consumption increased by 8.5%, driven by an exceptional heatwave that put pressure on the electricity system.

Projections for the period 2025–2027 indicate an average annual growth of 6.3%, one of the highest in the world. A key factor is the rush to buy air conditioners: while less than 20% of households currently own one, these appliances already contribute 60 GW to peak demand, with record sales of 14 million units in 2024 (+27% compared to 2023). The latest estimates indicate that by 2030, cooling could account for over a third of national peak load, reaching 140 GW.

The relationship between rising temperatures and electricity load is becoming increasingly clear: in 2024, every additional degree Celsius of average daily temperature resulted in an increase of over 7 GW in demand, with a projection of up to 11 GW by 2027. To address this challenge, the government has introduced programmes such as PM-KUSUM, which promotes the use of solar pumps in agriculture, lightening the load in the evening hours and shifting it to the central hours. Furthermore, from 2024, Time-of-Day (ToD) tariffs have become mandatory for large users, encouraging consumption during hours of peak solar production.

However, the success of this expansion will depend on the authorities' ability to plan at the federal level and invest in key infrastructure: smart grids, energy storage and digital technologies for demand management will be essential to avoid bottlenecks.

Despite these efforts, the Indian grid is already under severe strain: in ten years, peak load has increased by 68%, from 148 GW in 2014 to 250 GW in 2024, and a 4.3% deficit in available capacity is expected in 2024. It is estimated that by 2027, shortages could reach 40 GW in the evening hours, especially if extreme temperatures continue to intensify.

To mitigate the risk of blackouts, the central authority has reactivated power plants fuelled by imported coal (+17 GW) and gas (+13 GW), postponing maintenance during critical periods. At the same time, some federal states, including Uttar Pradesh and Maharashtra, have launched autonomous plans to improve adequacy. However, the absence of integrated national governance leaves the risk of structural imbalances open.

From an environmental perspective, the situation remains critical. CO₂ intensity in the Indian electricity sector is expected to be around 700 gCO₂/kWh in 2024, one of the highest in the world. Despite the increase in renewable capacity, projections up to 2027 indicate a stable or slightly increasing trend, confirming the strong dependence on coal, which continues to dominate the national energy mix.

China: an extraordinary case study

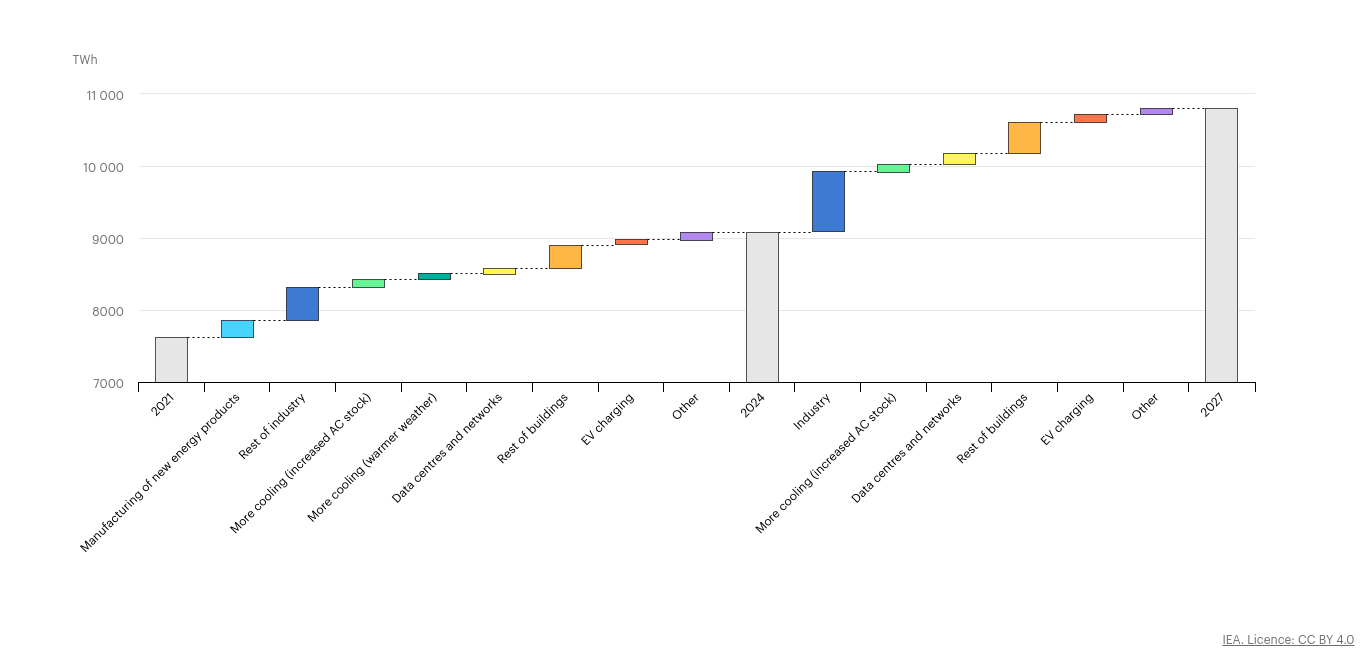

China is now one of the most emblematic cases of the global electricity transition. With demand expected to reach almost 10,000 TWh in 2024, the country accounts for over a third of global electricity consumption, consolidating its position as the beating heart of the global energy system.

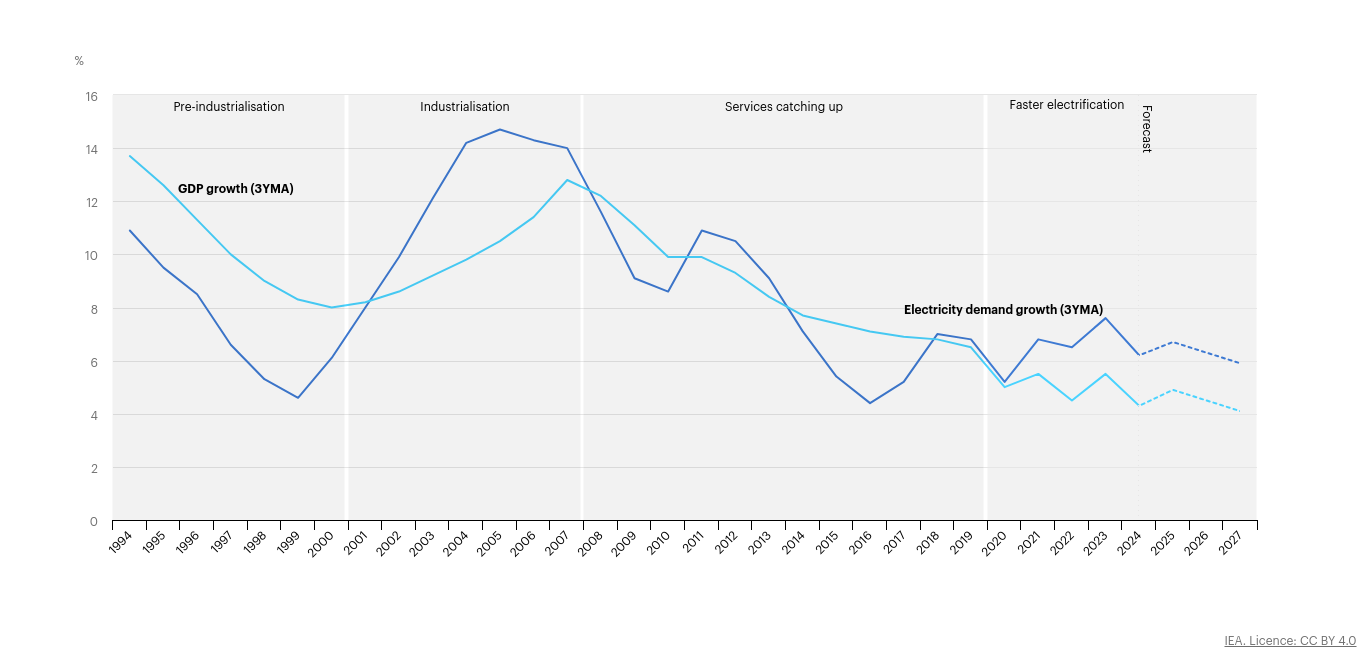

In the two years 2023–2024, electricity demand grew by 7% per year, outpacing the national economy, which is growing at around 5%. This misalignment highlights the strategic role of electricity in the country's industrial and technological transformation.

The industrial sector remains the main driver of demand, accounting for around 60% of the total. The production of solar panels, batteries and electric vehicles accounts for a significant share: in 2024 alone, factories dedicated to clean technologies used around 320 TWh, equivalent to a country such as Italy's entire electricity demand. Added to this is the growing electrification of industrial processes, which is further driving consumption.

Another structural factor is the widespread use of air conditioners, now found in 80% of homes, with an annual growth rate of 6%. At the same time, the boom in data centres and 5G networks contributes about 4% to total demand growth, while the electric vehicle sector exceeded 100 TWh of consumption in 2024, equal to 7% of the increase expected in the 2025–2027 period.

Overall, the share of electricity in China's total energy consumption reached 28% in 2024, surpassing the United States (22%) and the European Union (21%).

The new energy vehicle (NEV) market has experienced exceptional growth: an estimated 30 million NEVs are on the road since the end of 2024, 70% of which are fully electric. The electric car fleet grew from 3% to 9% of the total between 2021 and 2024, with 11 million new NEVs registered in 2024 alone (+51% compared to 2023).

The record heat waves between July and August of last year, the most intense in 60 years, increased cooling days by 8%, but their direct impact on demand remains limited: only 0.6% of growth is linked to climate factors, while over 90% is due to structural trends such as industrialisation and digitalisation.

China's strategy for electricity system resilience is centered on major investments in technological innovation. Priorities include smart grids, large-scale storage and the digitalisation of distribution infrastructure. One example is the programme named Eastern Data, Western Computing, which reduces loads in urban centres by shifting them to regions with abundant renewable energy, thereby optimising energy efficiency and the integration of renewables.

A less visible but strategic phenomenon is the indirect export of electricity embedded in manufactured goods: in 2024, approximately 340 TWh were exported in this form, of which 120 TWh were in clean energy products alone - more than the entire electricity consumption of the Netherlands. This 'invisible export' accounts for 6% of Chinese industrial demand and contributed to 60% of the increase in indirect electricity exports between 2021 and 2024.

On the digital front, China has 4.25 million 5G base stations and over 1 billion active users, with a penetration rate of 71%. Data centres consume between 70 and 130 TWh, while telecommunications networks consume around 100 TWh (2023 figure), with growth rates of 6–10% and 7% respectively.

From an environmental perspective, China remains heavily dependent on coal, but in 2024, it still recorded a modest reduction in CO₂ intensity of -1.2%, due to the growth of renewables. Intensity currently stands at around 620 gCO₂/kWh, with an average annual decline of 3% forecast for the period 2025–2027, which could bring it to around 550 gCO₂/kWh by 2027.

Growth rates of electricity demand and GDP in China, 1994-2027

Estimated drivers of change in electricity demand in China, 2021-2027

United States: dynamic and digital growth

In the United States, electricity demand is experiencing a marked recovery, with an estimated increase of +2% in 2024, following a decline of 1.8% in 2023. Forecasts for the 2025–2027 period indicate average annual growth of 2%, a significant revision from the previous +1%, reflecting new structural drivers in the US electricity economy.

A key factor is the explosion in demand from data centres, whose consumption rose from 60 TWh in 2014 to 176 TWh in 2023, accounting for over 4% of the national total. In the first six months of 2024, new projects for 24 GW of capacity were announced, almost tripling the 2023 figure, with strong concentration in Virginia and Texas.

Digitalisation is accompanied by other growing sectors: high-tech manufacturing (such as semiconductors), the electrification of heating and transport systems, and increased residential and commercial consumption. Network operators such as PJM and ERCOT foresee even more pronounced expansion scenarios, with ERCOT estimating a possible +10% increase as early as 2025 in an accelerated development scenario.

The electric vehicle market continues to grow, albeit at a slower pace than in previous years: in 2024, sales increased by +10% (compared to +40% in 2023), but market share reached 10%, a sign of a now well-established transition. Heat pumps are also contributing to growth, as is the expansion of digital networks and data centres.

However, despite this positive trend, structural risks are emerging in terms of system adequacy. According to the North American Electric Reliability Corporation (NERC) 2024-2025 Winter Reliability Assessment report, nine out of 20 regions in the United States are classified as high risk for inadequacy, including the Midwest (MISO), Texas (ERCOT) and California. In particular, MISO may not meet reserve standards even under normal conditions by 2029, while delays in new plants and pipelines are increasing vulnerabilities in several areas.

On the environmental front, the gradual replacement of coal with natural gas and renewable sources has produced concrete results: in 2024, CO₂ intensity fell by 2.9%, settling at around 400 gCO₂/kWh. The trend remains downward, with an average annual reduction of 2% forecast until 2027, bringing the value to around 360 gCO₂/kWh.

To ensure a safe and sustainable transition, the IEA highlights the importance of targeted policies: incentives for renewables and electric vehicles, investment in smart grids and storage systems, and the creation of flexible electricity markets are needed. Technologies such as demand response, distributed storage, and the integration of electric vehicles as network resources are crucial to balancing the growing variability of renewable sources.

Finally, the development of advanced digital tools, such as digital twins and stochastic simulations, enables more accurate and resilient planning, improving the system's ability to cope with increasingly frequent and unpredictable extreme weather events. Technological innovation, combined with national and international decarbonisation targets, thus paves the way for a more efficient, secure and low-emission electricity system.

European Union: a fragile and fragmented recovery

In Europe, the recovery in electricity demand appears fragile and conditioned by both cyclical and structural factors. After two years of significant contraction (–2.8% in 2022 and –3.3% in 2023), 2024 marks a modest rebound of 1.4%, supported by innovative sectors such as data centres, heat pumps and electric mobility. However, electricity demand remains below pre-pandemic levels: according to current forecasts, 2021 consumption will not be recovered before 2027.

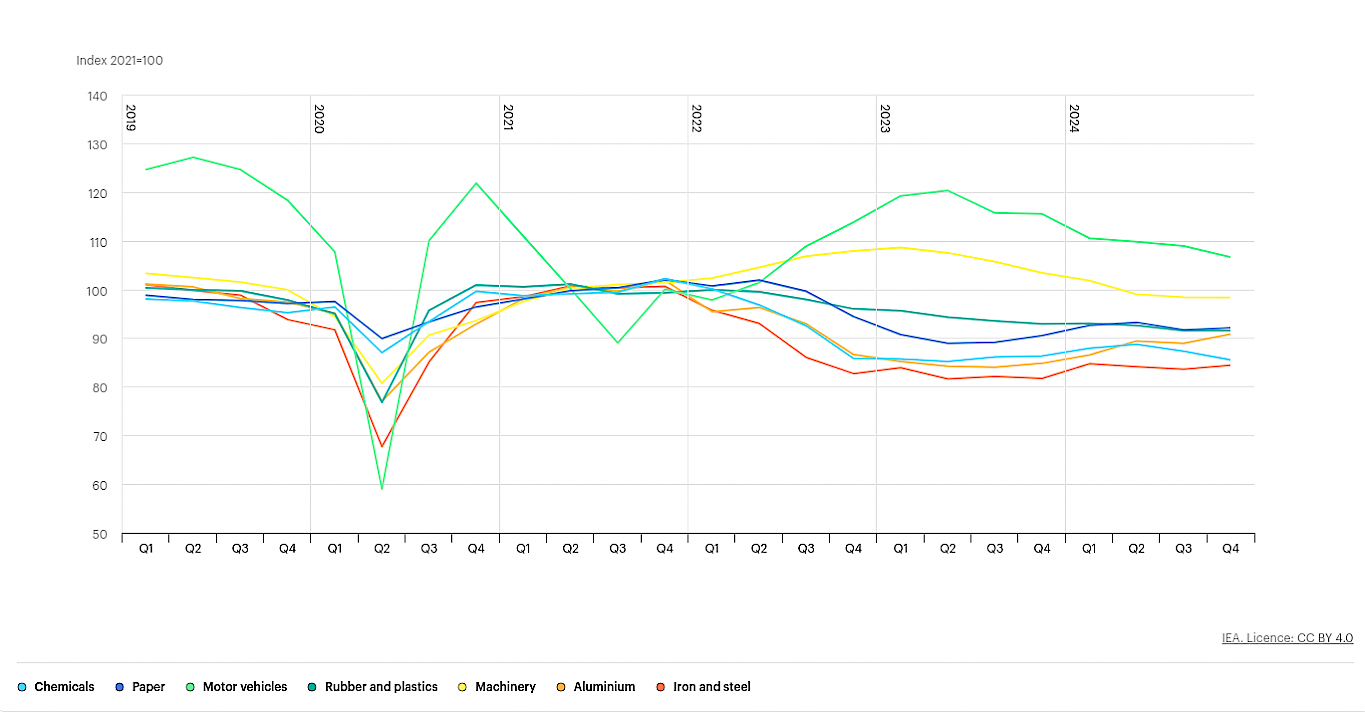

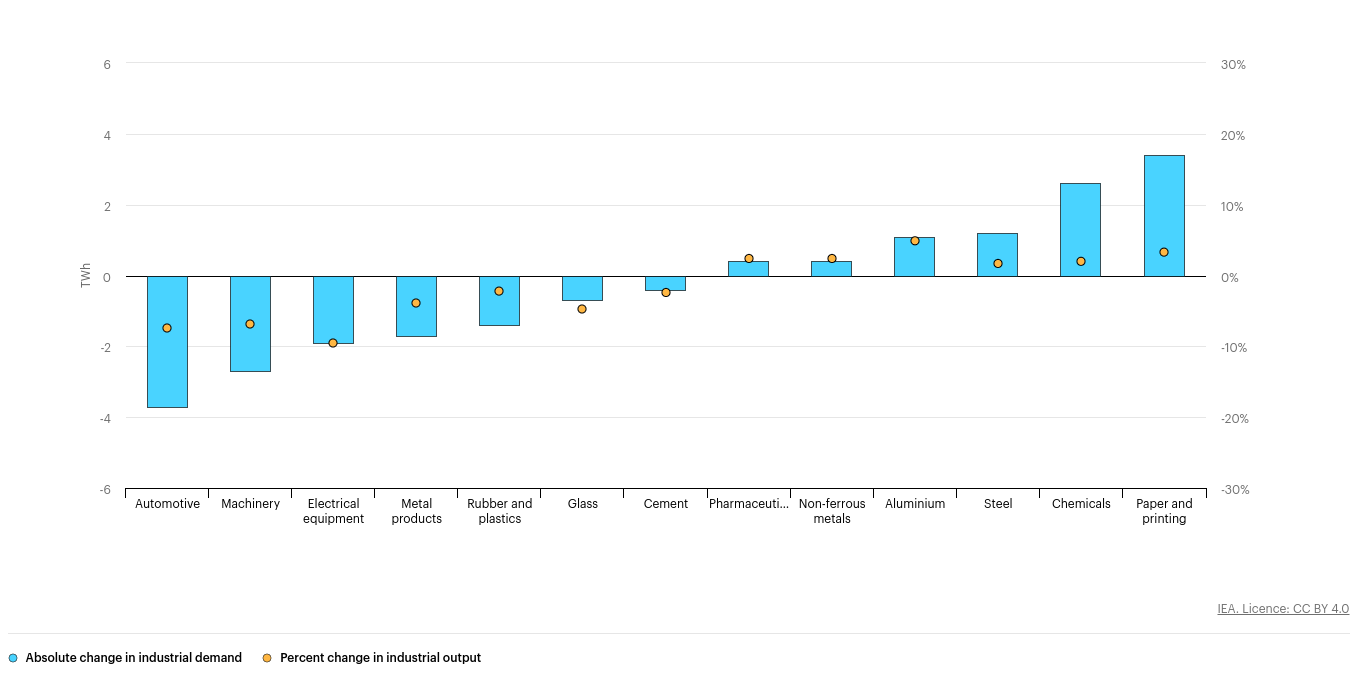

In the industrial sector, overall stability masks deep sectoral crises: primary metals are among the hardest hit, with plant closures and structural losses in demand, with steel struggling to recover, hampered by international competition, high energy costs and restrictive interest rates. The automotive industry is also under pressure, with job cuts and difficulties in the battery supply chain.

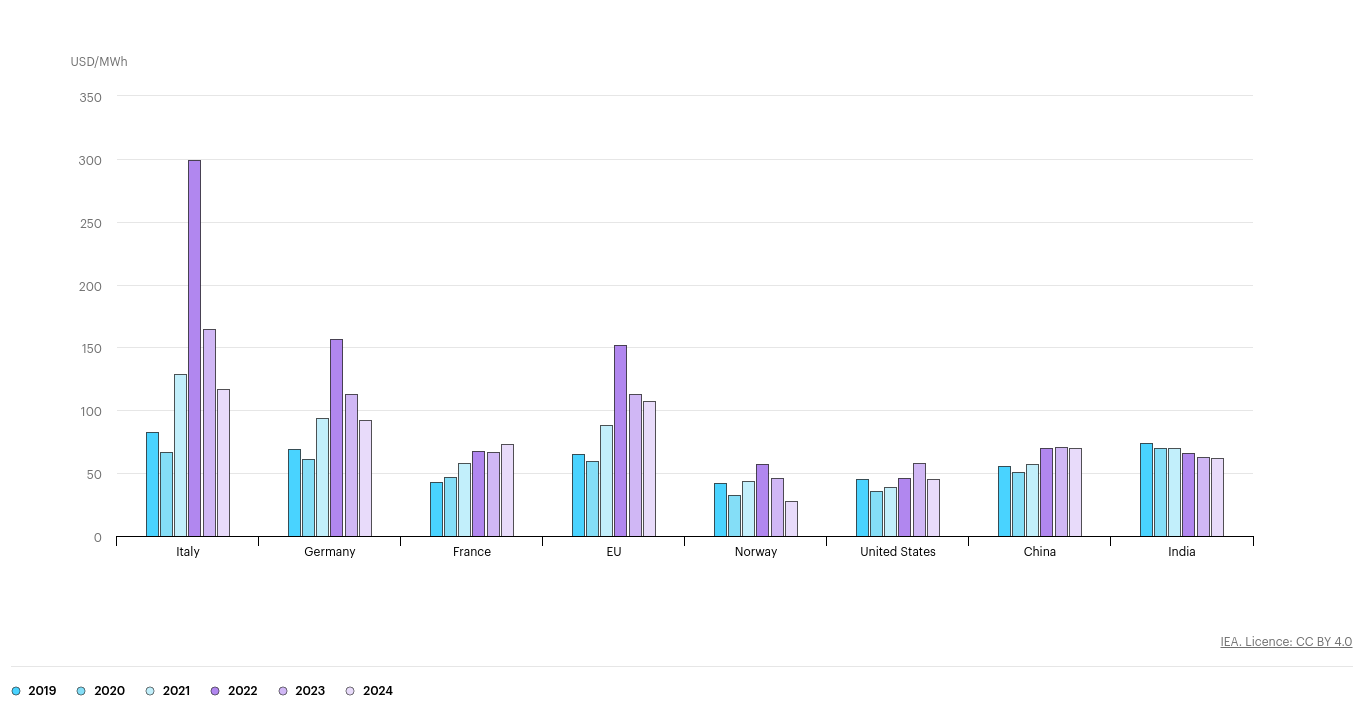

The price of electricity for energy-intensive industries is a crucial issue: in 2024, costs are 65% higher than in 2019, double those in the United States and 50% higher than in China, undermining European manufacturing competitiveness. Compensatory measures remain fragmented and uneven: Germany covers 100% of indirect costs, while Italy (25%) and Spain (45%) are taking more limited approaches.

The electrification of final consumption is also showing signs of slowing down. In 2024, sales of battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs) declined, penalised by the end of incentives in Germany and tax reforms in France. The only exception is Belgium, where growth remains strong. Heat pumps recorded an even sharper decline: -47% in the first half of 2024, the combined effect of reduced subsidies and falling gas prices, which makes switching to electric less attractive.

High electricity prices for households exacerbate the situation: in 2024, taxes and charges meant that the average price of electricity was 2.6 times higher than that of gas, with a tax incidence 130% higher than gas. This discourages the domestic use of efficient electrical technologies, such as heat pumps and electric cooking systems.

In terms of the adequacy of the electricity system, ENTSO-E expects a generally stable situation for winter 2025/2026, but points to potential criticalities in Ireland and Finland in the event of extreme cold spells. In addition, the unplanned decommissioning of conventional plants could lead to imbalances in Central and Northern Europe by 2028.

To relaunch the European energy transition and strengthen competitiveness, Brussels is focusing on smart grids, storage systems and flexibility technologies such as demand response and the bidirectional integration of electric vehicles. Ambitious policies and targeted incentives are needed to reduce disparities between countries and strengthen climate and industrial resilience. Digital innovation will be crucial, especially to optimise the use of renewables and ensure system stability through solutions such as advanced storage, demand forecasting and smart grid automation.

From an environmental perspective, the European Union stands out for its decline in CO₂ intensity, with a 14% reduction in 2024, due to a sharp decrease in coal-fired electricity (-15%) and the expansion of renewables and nuclear power. The projected trend is -10% per year until 2027, with intensity falling from 175 to 130 gCO₂/kWh, strengthening Europe's leading role in the global decarbonisation.

Production indices of selected industries in the European Union, 2019-2024

A global picture of growth and inequality

The picture painted by Electricity 2025 shows accelerating global electricity consumption growth, closely linked to the ongoing technological, industrial and environmental transformation. India stands out for its rapid and extensive expansion, driven by the spread of air conditioning, urban population growth and profound infrastructure challenges. At the same time, China and the United States are showing more structured growth dynamics, supported by digitalisation, advanced manufacturing, electric mobility and coordinated investment in electricity grids, with infrastructure capacity that allows new loads to be integrated while maintaining system stability. Europe, on the other hand, is facing a weaker and more fragmented recovery, hampered by industrial crises, high energy prices, policy disparities between member states and a more uncertain macroeconomic environment.

Despite these regional differences, all major economies are converging on a common trajectory: the electrification of final consumption is at the heart of decarbonisation strategies. Transport and heating are gradually being electrified, but the ability to absorb these new loads increasingly depends on the resilience and flexibility of networks. Smart grids, storage systems, dynamic demand management and the integration of electric vehicles as distributed resources are therefore becoming central. Emerging technologies such as digital twins, artificial intelligence, advanced forecasting and modular storage are helping to make electricity systems more adaptive, especially in response to increasingly frequent extreme weather events.

Globally, the growth in demand expected by 2027 will be fully covered by low-emission sources, with renewables and nuclear playing a dominant role in the new electricity mix. The decline in CO₂ intensity is significant: an average annual reduction of 3.6% between 2025 and 2027 will bring the figure from 445 to around 400 gCO₂/kWh. However, the trajectory is asymmetrical: Europe is leading the decline thanks to its exit from coal and the revival of nuclear power, while the United States and China are improving more gradually, and India remains at high levels, albeit declining slightly.

Ensuring the adequacy of the electricity system in this context is increasingly complex. Traditional deterministic models are no longer sufficient to manage the growing uncertainty associated with the variability of renewables, increasing load peaks and the impacts of extreme weather. For this reason, system operators in countries such as the United States, the EU, China, India, Australia and Brazil are adopting advanced probabilistic models, such as Monte Carlo simulations, which can explore thousands of scenarios and improve system planning and security.

Finally, the transition to electricity is not only a technological challenge but also a matter of global equity. In sub-Saharan Africa, around 600 million people still do not have access to reliable electricity. Bridging this gap will be essential to ensure that decarbonisation is sustainable, inclusive and shared. This will require ambitious policies, enhanced international cooperation programs and fair financing mechanisms to ensure that electrification does not amplify inequalities but contributes to reducing them.

In this scenario, electricity is no longer just an energy carrier: it has become the enabling infrastructure for the economic, social and environmental transformation of the 21st century.