The global transport sector accounts for around a fifth of the world’s greenhouse gas (GHG) emissions. In the European Union, following a hiatus due to the pandemic, the transport sector emissions grew again to reach a 25% share of the overall Union’s GHG emissions. Within this sector, road transport is the biggest emitter, responsible for some 70% of the total emissions. Therefore, e-mobility plays a key role in decarbonising this sector and accelerating the green transition.

The European EV market is booming: more than 695,000 new EV were registered in the EU in the last trimester of 2022, a 30% increase in comparison with the same period the year before, according to the Commission’s EU electricity market report - fourth quarter 2022. Globally, there were more than 26 million electric cars rolling in 2022, 60% up as compared to 2021.

A widely available and reliable network of public charging points is required to support the ever-increasing number of electric vehicles on the road, all over the world. The EU and the US established the EU-US Trade and Technology Council (TTC) in June 2021 to coordinate approaches to key global trade, economic and technological issues based on shared democratic values. The collaboration on e-mobility and interoperability with smart grids, developed in this framework, supports shared commitments to clean energy and decarbonisation, and the endorsement and further development of international standards for EVs and their charging devices.

Their latest report highlights how new technologies and communication standards will enable to manage demand when many EV are charging at the same time. Developing and implementing cost-effective smart charging infrastructure will thus be crucial in better exploiting and integrating renewable electricity such as solar and wind power, and so to ensure the stability of electric grids. Regional and local authorities have a leading role in the uptake of e-mobility and sharing best practices will be important to bring more certainty to public authorities and private, often government-subsidised, investors.

The technical recommendations also address the need for harmonised standards to minimise trade barriers. Manufacturers and suppliers in the EU and the US could benefit from international standards to cut costs and development times while maintaining their competitiveness across global markets and fostering innovation. Developing consumer- and grid-friendly charging solutions requires further pre-normative research and common testing methods, too.

Coherently, The European Parliament has adopted new rules that will see more EV charging stations available across the EU. The new regulations adopted by MEPS will ensure that EV charging stations are situated every 60km for cars and every 200km for trucks and buses.

This initiative for alternative fuels and EV charging stations is part of the EU’s Fit for 55 in 2030 package, which aims to reduce greenhouse gas emissions by 55% by 2030, compared to 1990 levels. EV charging stations for cars with a minimum 400 kW output will be deployed across core Trans-European Transport Network routes by 2026, with power output increasing to 600 kW by 2028. Charging stations for trucks and buses will be installed on half of all EU main roads by 2028 with a power output of 1400kW to 2800 kW, depending on the road.

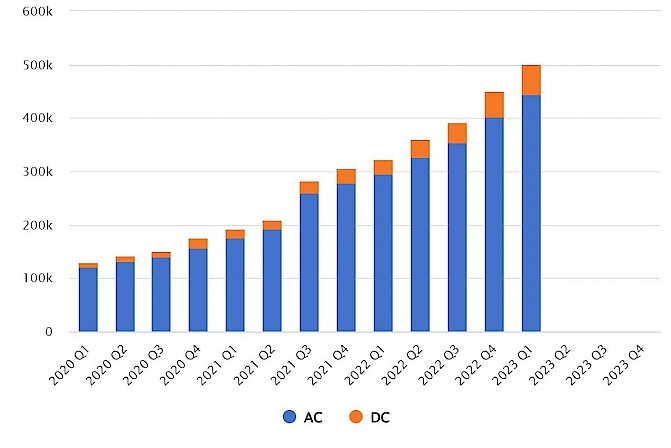

These developments boost a sector that has already seen considerable growth in the last years: the market for charging stations in Europe has grown from around 10,000 in 2012 to half a million units in 2023.

Total number of recharging points, according to the AFIR classification (Source: European Commission - European Alternative Fuels Observatory)

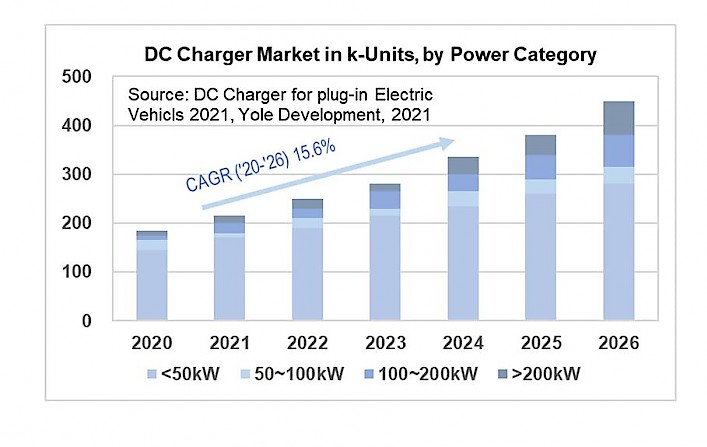

EV charge stations can be classified into 3 types: AC Level 1 – Residential Chargers, AC Level 2 – Public Chargers and DC Fast Chargers to support quick charge for the EVs. With the global penetration of EVs accelerating, the widespread use of charging stations is essential, and Yole Group's forecast (below) predicts that the DC charger market will grow at a compound annual growth rate (CAGR 2020-26) of 15.6%.

DC Charging by Power (Source: Yole Group)

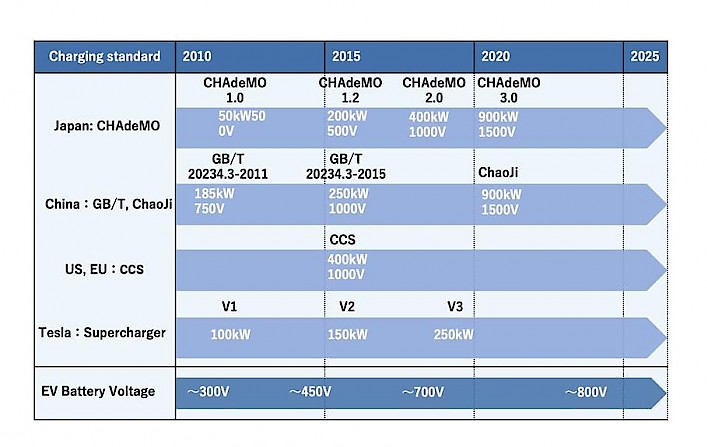

The following figure shows the market trends for each DC charging method and EV drive battery voltage. Reducing the charging time is essential for EV penetration, and the shift to charging methods that support higher power and higher voltage is progressing. Also, by modularizing the internal power supply unit and allocating power according to the load, it is possible to charge multiple EVs at the same time, which is expected to eliminate charging congestion.

Market Trends in DC Charging Method and EV Drive Battery Voltage

We can clearly see that the trend for DC charging is towards higher power and higher voltage. Hence the components used are desired to have lower power losses. This is because at higher power delivery even if the system efficiency is the same the total power loss can be very high. For example: 98% efficient 50kW DC Chargers have 1KW power loss and 400KW DC Chargers with the same efficiency would have 8KW power loss, resulting in a very large cooling system. This pushes engineers to consider New Generation Power devices to reduce power loss.

In this pivotal moment, where demand is increasing with an ever-growing EV penetration still at early adopter stage, it is crucial for providers, producers and investors operating in the EV charging sector to work closely to define standards that can be quickly deployed in the field to avoid hiccups. In order for EVs to be seen as broadly viable, beyond early adopters, an abundance of charging stations where people live, work and “play” is critical.