FAIST’s electronic actuators: the development as seen by CPS division’s Business Director

FAIST as a group has always been extremely driven towards innovation, with the goal of satisfying its customers’ needs. We spoke to Leonardo Laganà, Business Director of the Controls & Propulsion Systems division, to understand the reasons that lie behind the introduction of electric actuators in the products portfolio and to trace what has been FAIST’s path in the development of this range of sought-after turbocharger components.

Why has FAIST decided to enhance the importance of the electric actuation within its products portfolio?

Innovation and the pursuit of excellence represent essential parts of our company culture, and are, more importantly, what allows us to adequately cover the necessities of our automotive customers. Over the course of the last two decades, the Controls & Propulsion Systems division has therefore constantly invested in widening its products offering, developing many pneumatic drive systems and integrating positioning sensors and complete valve systems in the range; this allowed us to reach a global leadership position in the sector of controls for forced induction internal combustion engines.

Electric actuation, whose development program started in 2002, represented a natural continuation of the integration we needed in our products offer to defend that leadership, especially in the turbochargers market, where in the last years we saw a clear surge in the demand of this type of products.

The completeness of the actuators range proposed, our notable vertical integration both in product development and in our productive processes, our embedded inclination to customizing for the specific application, united to a consolidated experience in the complex sector of forced induction and to our global presence, are at the same time crucial elements for our clients and their competitiveness, and distinctive traits of FAIST’s in its competitive framework.

When did the EA research and development process start?

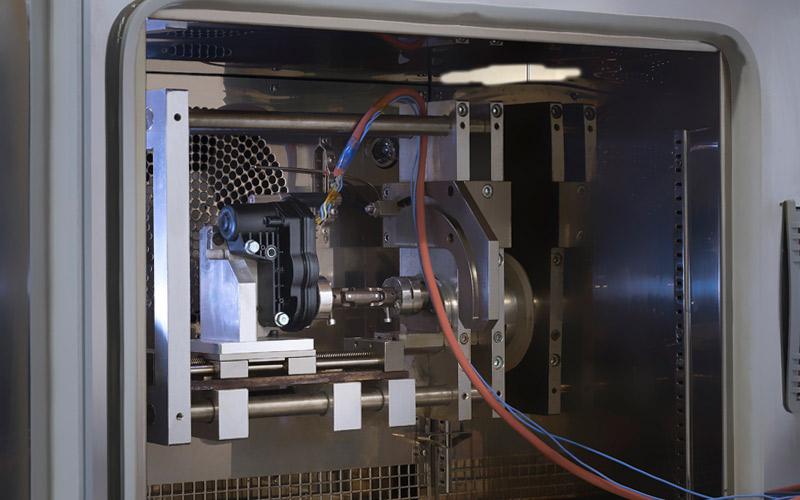

As stated before, the starting point was in 2002 with the development of an electro-mechanic smart actuator (EMA), which thanks to a solenoid, a hybrid positioning sensor and electronic control for the interfacing with the ECU, could operate a rod connected to the turbocharger’s variable geometry system. This study got to the stage of testing the prototype on the vehicle, then it was halted because reducing the weight of the assembly to a level that would have been acceptable on the market would have meant increasing the cost of the product too much.

That system anyhow gave us the chance to expand our knowledge in the domain of magnetic fields generation, in sensor’s operating principles and in control electronics.

The product development strategy was then carried on on two parallel lines. On one side, we kept working on the internal development of contactless sensors that could be integrated into our drive systems, a project that had an extremely positive evolution, and was launched in production in 2009, leading to the current sensors’ offering in our products range. On the other, trying to answer to the high electronics engineering content requested to the peripheral devices’ actuation systems by the limited elaboration capacity of the ECU in Euro IV platforms, we signed a triannual agreement of co-development with a partner to create a smart actuator. Unfortunately, this collaboration ended in 2009 after the project development phase, not allowing us to delve deeper into the productive phase of the project.

In the following years, we continued to work autonomously developing our current range of electric actuation, which encompasses waste-gate applications and variable geometry in the turbo-gasoline field, up to drive systems for cylinders de-activation – products now used by a substantial number of OEMs.

How many people have been involved in the development of these products?

Excluding from this count external collaborations with centres of excellence and research institutes, we have various levels of involvement in this development plan.

The first one is the product development, which unites a team of 21 persons composed of engineers and technics for the development and validation process. They work on developing the concept and later the design.

Then there is the process development team, made of 12 engineers and technicians, in charge of designing and realizing the tooling and the machines that are used in the new processes.

In addition we have a team of 15 engineers, divided in Customer Teams, who keep in contact with the clients, evaluating their necessities and modifying the product creating custom versions for specific applications.

How have the products changed during their development?

Being extremely focused on the customers’ requests, we started with a high-performance product, which delivers a torque that can get to holding torque values exceeding 3Nm. This product immediately placed itself as top-of-the-range, and then we downscaled it developing two additional actuators with reduced torque values that are compatible with the majority of our clients’ programs.

The same process of development and modification was done with the variable geometry actuator, which has been furthermore affected by the allotted space available for its packaging to be inserted on the turbocharger and in the engine compartment. For this reason two different types of products have been developed: one more classical with a transversal reduction group, and one more compact with the reduction group that develops in axial direction in respect to the exit shaft.

What do you think the future of forced induction engines will bring?

In the desirable future centrality of the hydrogen economy, to be applied also in the mobility sector, OEMs are widening their current offer of propulsion systems’ typologies a lot, especially thanks to the introduction in the range, together with increasingly efficient ICEs, of solutions with different grades of electrification, from MHVs to PHEVs and BEVs. These seem to be a solution that is neither technologically convincing from an environmental point of view as a way of solving the problem of GHGs, nor one that could be easily scalable to notable market shares in most areas of the world. Considering also the different motoring approaches that the various OEMs have in hybridizing their platforms, we forecast the evolving scenario of the next five to ten years to be composed by around 70% of new vehicles produced with various forced induction systems, which leaves great growth margins to this sector.

In any case, turbochargers must therefore be present in the engines’ structure in the future to guarantee better emissions regulation, and with a turbocharger comes a regulation component, which will be almost exclusively electronic. An example of this trend is the recent fitting of Miller cycles onto small gasoline engines combined with variable geometry turbochargers.

Our intention is to continue to widen our electric actuation products range in different frameworks as well, even far from the regulation of forced induction systems.

How have you seen the automotive business change in time?

Given that, if the automotive world wouldn’t have evolved and would not continue to do so, FAIST would not have had the possibilities it has seized and would not be able to look at the future with confidence and positivity – certainly, in the course of the years, we witnessed an evolution of our outlet sectors in the automotive field. These have transformed from highly technological sectors to actual commodities, with all the consequences that this change has on a supplier, for better or for worse. This happened because of the combination of two circumstances: the normal lifecycle of a product, which leads to its maturity, and globalization, which in this case is to be read as a positive application of such products in broader markets.

This scenario of great competitiveness and low margins now risks to be jeopardized by an element of confusion and uncertainty for automotive suppliers. This uncertainty is often determined by environmental policies and regulations in the sector that lack technologic neutrality, because of the exponential increases of development costs that they impose, in front of which not all OEMs respond with a comparable strategic reaction.