In recent years, the sector of renewable energy has experienced an impressive growth.

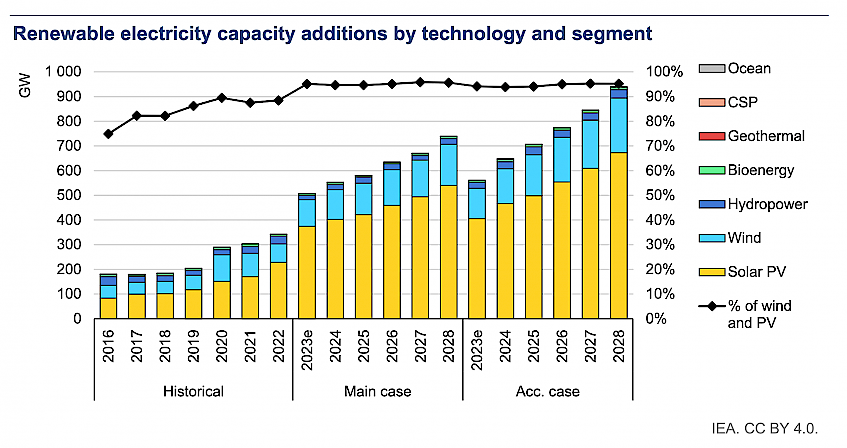

The Renewables 2023 report by the IEA - International Energy Agency - shows that in 2023 the world added 50% more renewable capacity than in the previous year (almost 510 gigawatts (GW)), the fastest growth rate in two decades.

As stated in an article published by the IEEFA - Institute for Energy Economics & Financial Analysis, in 2022, solar and wind energy accounted for 80% of the additional electricity demand and 12% of the electricity generated globally.

According to the International Energy Agency's (IEA) Net Zero Scenario, solar energy generation is expected to grow at an annual rate of 25% up to 2030.

Investment in solar power generation reached almost US$ 500 billion in 2022, marking an increase of US$ 80 billion over the previous year.

In contrast, investments in wind energy will amount to US$ 162 billion in 2022, down 5% from 2021 levels.

This growth - key for the achievement of the decarbonisation targets to be reached by 2050 - also has a flip side to the coin, in terms of the vulnerabilities and challenges that the renewable energy industry will face in the near future, as listed by IEEFA.

1. Geographical disparities

The first challenge to tackle is the geographical disparity in investment in renewable energy, which has increased exponentially, but not equally, worldwide.

Indeed, developed countries and China account for more than 80% of global investments in renewable energy.

China alone contributed 52% of global clean energy investments in 2022, with a 42% share in solar and 55% in wind power.

Among developing economies, only India and Vietnam are in the top 10 for adding renewable capacity from 2013 to 2022, while many parts of the world, especially emerging and less developed countries, lag far behind.

For example, in South-East Asia, investment in renewable energy decreased by 7% in 2022 compared to 2021, reaching US$ 5.2 billion, also due to a significant drop in foreign green investment, with a fall of more than 50% year-on-year in 2022.

At the macro level, developing countries' annual needs of US$ 1 trillion are still far from being met. Grants and subsidised loans account for less than one per cent of global renewable energy financing, and IRENA estimates recent annual investments by developing countries at US$ 0.5 trillion, three times less than the level required to meet the 1.5°C target established in the Paris Agreement of 2015.

2. Increased cost of financing

IEEFA points out that the financial difficulties are not related to access to adequate forms of credit, but to their cost, due to the increase in interest rates over the past two years.

A 4-5% increase in interest rates translates into an additional 4-5% in project costs each year.

This is even more evident in developing countries, where there is a greater dependence on external financing, which becomes scarce when international interest rates rise to curb inflation.

On the other hand, as explained earlier, the drop in foreign funding has already hit South-East Asia hard.

Action by governments and international banking institutions is therefore needed to encourage investment in renewable energies, also considering the global climate benefit they generate.

3. Non-financial barriers

In addition to the above-mentioned financial difficulties resulting from rising interest rates, there are also so-called non-financial barriers.

T this term refers to a lack of political clarity, onerous or unclear authorisation requirements and challenges in land acquisition.

These factors prevent the 'bankability' of a project, interrupting or slowing down the flow of finance, most frequently in those countries already lagging behind on decarbonisation targets.

4. Investment in infrastructure and storage

In order to achieve the goals of the NZE Scenario - The Net Zero Emissions by 2050 Scenario developed by the IEA - renewable energies must be a substantial part of the global energy mix, ensuring a stable supply regardless of weather conditions.

This requires significant investment in networks to improve their resilience to the inherently intermittent variability of sun and wind as sources of energy.

Grids play a crucial role in the energy transition, transporting clean energy from generators to communities and connecting renewable sources. The integration of renewable energy also requires energy storage solutions to balance variable production and ensure a reliable energy supply.

For this to happen, investment in grids and storage needs to double by 2030, reaching US$900 billion per year according to the NZS. This implies the need for governments to overcome physical, administrative and procedural hurdles, while investors must support rapid and abundantly-funded development of renewable energy.

Conclusions

As stated in the article 'The world added 50% more renewable capacity last year than in 2022' published on the World Economic Forum website on 8th February 2024, following the COP28 calls to triple renewable energy capacity by 2030, the growing momentum towards decarbonisation could lead to the fastest growth of renewable energy in the next five years.

In order to achieve these goals, however, it is necessary to remove, or at least substantially reduce, the existing obstacles that are in fact holding back the growth of the global renewable industry